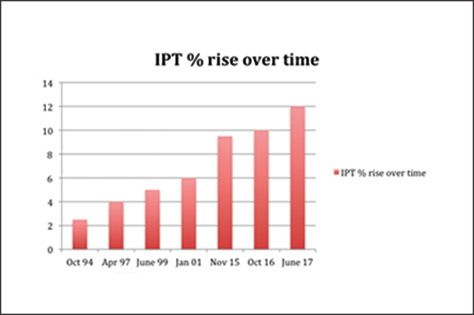

The insurance premium tax (IPT) is rising again – this time to 12%. Philip Hammond, the Chancellor recently announced this latest rise is due to take place in June 2017. Where will it stop?

There has been a steady rise for a number of years and has become known as the UK’s fastest growing stealth tax. It has been raised 3 times in the last 18 months. Insurers have warned that with this latest increase it could lead to underinsurance as the change is described as an “unwarranted attack”.

The British Insurance Broker’s Association (BIBA) angrily responded to the rise by issuing this statement. “In this time policyholders have already seen an increase of 66% in IPT – this further increase to 12% in this regressive tax is outrageous and is a tax on protection which will hit everyone and especially those ‘just about managing’.

We believe that this increase is contrary to the stated policy of HM Revenue and Customs “that IPT should make the required contribution to HM Government revenue while minimising the effect on the take up of insurance

Who is going to feel it the most?

In basic terms all household and businesses that purchase insurance will be affected. IPT affects more than 50 million policies and applies to those purchased by businesses, charities and individuals. Taken together the combination of the last 3 rises will raise over £13 bn for the Government over 5 years.

There are differing views but yet again motorists will be hardest hit, specifically young drivers. The AA is reported saying that this latest increase will add around £10 a year to the average car insurance premium.

Steve Treloar, Managing Director of LV said “the government has incorrectly stated that insurance premium tax is a tax on insurers – it’s not, it’s a tax that consumers have to pay when they purchase insurance”.

Tim Ryan, Executive Chairman of UNA Alliance is quoted as saying “This is a significant blow. As a result this will significantly hit the pockets of families throughout the country with significant figures being added to the average buildings and contents policies.’

There is concern that these will not be the only rises and in time it could reach 20%

What can you do to tackle these rises.

We would recommend you talk to us. As a broker we have strong relationships with many insurers which means we are not tied to just one company. It’s up to us to help you find you the best possible deal that is tailored entirely to your needs. We can review your current policies, business and personal ensuring you’re not paying more than you need to and look out for all of those hidden costs.

For a personal approach to insurance why not give us a call on 01494 450 450 or contact us here.